Fuel Your Business Growth and Impact

At BII, we do more than just write checks—we invest in people, places, and enterprises building a just and sustainable economy. Our integrated capital approach brings together the financial tools, strategic support, and relationships that entrepreneurs need to grow thriving, resilient businesses.

Capital

We offer fair and flexible financing that’s designed to meet you where you are, including term loans, lines of credit, revenue-based financing, convertible notes, and equity investments.

Coaching

We provide hands-on technical assistance, strategic advising, and access to resources to help you grow your business, expand your team, amplify your social or environmental impact, or plan for long-term success.

Connections

We open doors by connecting you with mission-aligned investors, peers, and partners to support your sustainable growth

Who and What We Fund

We invest in diverse entrepreneurs—immigrant, working-class, and others—who are building impact-driven businesses, cooperatives, and community-led real estate projects across Massachusetts, New England, or Upstate New York.

Impact-Driven Businesses

Innovative solutions that support good jobs, expand worker ownership, and increase climate resilience across New England

Community-Owned Real Estate

Projects that support community ownership and governance and increase affordability—from community land trusts to housing and business cooperatives in New England

Is BII Capital Right for You?

We support founders and organizations that are already in motion, with a tested business model, early revenue, and a commitment to impact outcomes.

You might be a good fit if:

- You’re based in Massachusetts, New England, or Upstate New York.

- Your enterprise is generating revenue or has customer demand, and is ready to grow.

- Your work unlocks a new or unmet market, creates good jobs, expands worker ownership, develops community-owned real estate, or promotes climate resilience.

- You’re not able to access capital from traditional sources like banks or venture funds

Funding Options

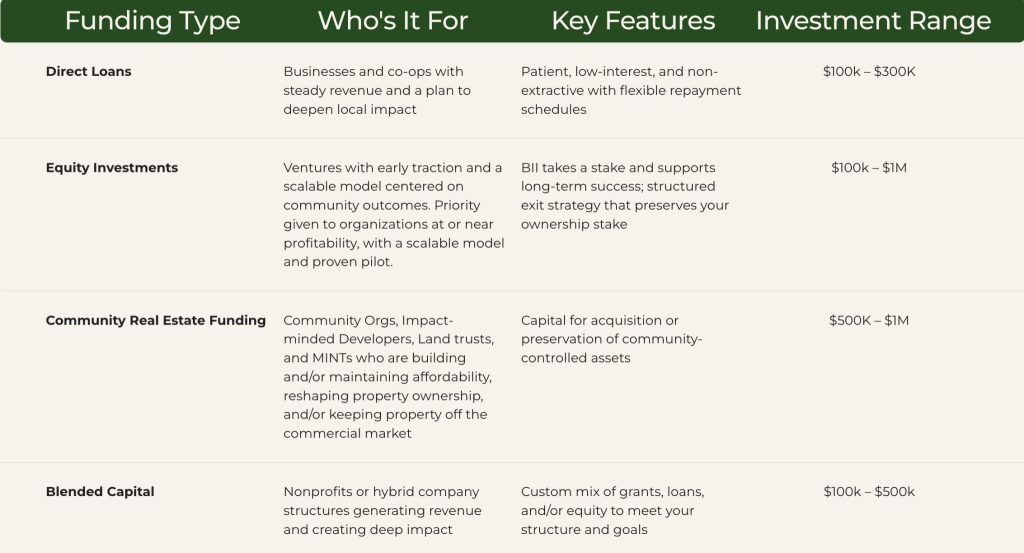

Funding Type

Who's It For

Key Features

Investment Range

Direct Loans

Businesses and co-ops with steady revenue and a plan to deepen local impact

Patient, low-interest, and non-extractive with flexible repayment schedules

$100k – $300K

Equity Investments

Ventures with early traction and a scalable model centered on community outcomes. Priority given to organizations at or near profitability, with a scalable model and proven pilot.

BII takes a stake and supports long-term success; structured exit strategy that preserves your ownership stake

$100k – $1M

Community Real Estate Funding

Community Orgs, Impact-minded Developers, Land trusts, and MINTs who are building and/or maintaining affordability, reshaping property ownership, and/or keeping property off the commercial market

Capital for acquisition or preservation of community-controlled assets

$500K – $1M

Blended Capital

Nonprofits or hybrid company structures generating revenue and creating deep impact

Custom mix of grants, loans, and/or equity to meet your structure and goals

$100k – $500k

All of our investments are structured to preserve your mission and support long-term success. For more financing options, visit our Debt and Equity page.

Funding Options

All of our investments are structured to preserve your mission and support long-term success. For more financing options, visit our Debt and Equity page.

Initial Intake Process

-

1. Check Your Eligibility

Make sure your business or project meets our criteria.

-

2. Submit An Interest Form

Tell us about your work and what support you need. We will follow up with your request.

-

3. Move Forward

If aligned, we’ll walk you through our trust-based investment process.

Our Trust-Based Investing Process

Check Eligibility

Check Eligibility

Tell Us About You

Tell Us About You

Meet the Team

Meet the Team

Share Numbers and Impact

Share Numbers and Impact

Technical Assistance & Coaching (If Needed)

Technical Assistance & Coaching (If Needed)

Present Your Vision

Present Your Vision

Investment Approval

7. Investment Approval

Legal Due Diligence and Term Sheet

8. Legal Due Diligence and Term Sheet

Funding and Partnership

Funding and Partnership

How we sustain your Impact

We’re with you every step of the way. Through the duration of our investment, we’ll work with you to expand your business and your impact, and set goals to support your growth. To ensure you’re on track, we’ll request periodic financial reports and impact assessments.

Not Quite Sure Where to Start?

Entrepreneur Support & Resources

Beyond funding, we provide resources, expert advising, and coaching to small businesses to ensure long-term success.

Business Coaching

Coaching

Access experienced mentors and advisors

Workshops & Training

Learn about cooperative models, funding readiness, and business growth

Peer Learning Communities

Connect with other entrepreneurs in BII’s network

Explore Business Resources

Access the latest perspectives, data, and resources on impact investing, investing for justice, and strengthening the solidarity economy.

Frequently Asked Questions

What types of businesses or real estate projects does BII consider?

We provide funding to businesses, cooperatives, and community-led projects that expand access to ownership, jobs, and long-term local stability. If your enterprise is building inclusive economic opportunity and is rooted in community impact, you may be a good fit.

What are BII’s investment criteria?

We seek to invest in social enterprises, including those owned by people of color and real estate projects that are catalyzing power in communities of color. We look for those who share our belief that a sustainable, inclusive and equitable economy is possible, as well as who owns, works at, and holds power, and what capacity the investment has to build financial, social, and political power for communities of color.

What types of capital does BII offer?

At the heart of our approach is the deployment of integrated capital, which means blending investment types—grants, debt, equity—to meet entrepreneurs and their enterprises where they are. We structure transactions using a variety of innovative financial structures:

Small Business Equity | Small Business Debt | Real Estate Debt & Equity | |

Capital Type | Preferred Stock Common Stock Convertible Notes SAFEs | Secured Unsecured Debt Lines of Credit Royalty Financing Receivables Financing | Equity Debt Bridge |

We believe integrated capital is a catalyst for economic justice. It’s central to every aspect of our work.

At what stage does BII invest?

We invest across stages, including Pre-Seed, Seed, Start-up, and Growth stages. We typically want to see your enterprise generating revenue or has customer demand. That being said, we encourage entrepreneurs to connect with us as early on as they’d like—we regularly provide coaching and technical assistance to enterprises that are not yet ready for BII investment to help them prepare for investment down the road.

How long does the investment process take?

The process varies and is very dependent on a prospective company’s investment preparedness. That said, many investments are completed within 4-5 months following the initial interest form.

What is BII’s investment process?

Businesses and real estate projects seeking investment first go through our relationship-based due diligence, which considers both the financial viability of the investment and its alignment with our investment criteria.

During this time, our team also frequently delivers technical assistance to enterprises, with topics ranging from strategy and financial projections to workplace democracy and equitable ownership. We do not use credit scores or other low-touch, historically biased means of financial evaluation. Instead, we seek to gain a deep understanding of the financial health, positioning, and people behind each enterprise to make an assessment of impact, risk and possible return.

Once an enterprise passes through our team’s due diligence, the team presents to the BII Investment Committee. The Investment Committee is appointed by the BII board to employ their expertise in evaluating opportunities along our investment thesis. Investment Committee members bring a wide variety of skill sets: finance backgrounds, successful entrepreneurs, solidarity economy principles, angel investors, and nonprofit leaders. They vote on each investment, either recommending the deal to the board for approval or passing on the opportunity at this time.

The board provides final approval on each deal to ensure that our investment activity is accountable to our mission.

What factors does BII consider when evaluating an investment opportunity?

We look at both the financial viability of potential investments and their alignment with our investment criteria. On the financial side, we review key financial documents, business plans, projections, and other investment specific factors to develop our assessment. On the impact side, we consider a number of factors relating to Economic Justice, Climate Resilience, Governance and Power, and Enterprise Health. We also form an assessment of the enterprise or project’s people—getting to know who we invest in is a key benefit of a relationship-based approach.

What does BII offer portfolio companies beyond its capital?

As integrated capital investors, we believe the best way to support organizations and build a resilient economy is by providing supplemental resources to portfolio companies in addition to our financial capital. We refer to these resources as Technical Assistance (TA). Our TA offerings include:

- Financial Modeling: We can analyze historical performance and review or create projections.

- Social Capital: We leverage our network for sales leads, sector experts, other investors and funders, potential partners, or other advisors and mentors.

- Coaching: Our team members make themselves available to talk through opportunities or challenges and provide advice

- Promotion: We use our platform (social media, website and newsletters) to lift up success stories.

- Specialized TA: We offer connections to trusted, local providers of Bookkeeping, Human Resources, and Marketing & Communications support. We offer grants to subsidize a portion of these costs.

- Portfolio Advisory Board: We offer our portfolio companies additional opportunities to connect, build their networks and learn from each other. Each year, we invite portfolio company leaders to join our Portfolio Advisory Board which offers: peer discussion groups, access to strategic advisors, peer networking and strategic relationship building, and sustainability practices.

Ready to Grow Your Business?

Get Started Today

Our team will guide you through the process to determine the best funding option for your business or project.