Impulse el crecimiento y el impacto de su negocio

En BII hacemos algo más que extender cheques: invertimos en personas, lugares y empresas que construyen una economía justa y sostenible. Nuestro enfoque de capital integrado reúne las herramientas financieras, el apoyo estratégico y las relaciones que los emprendedores necesitan para desarrollar negocios prósperos y resilientes.

Capital

Ofrecemos financiación justa y flexible diseñada para adaptarse a sus necesidades, incluidos préstamos a plazo, líneas de crédito, financiación basada en ingresos, pagarés convertibles e inversiones en capital.

Coaching

Proporcionamos asistencia técnica práctica, asesoramiento estratégico y acceso a recursos para ayudarle a hacer crecer su negocio, ampliar su equipo, amplificar su impacto social o medioambiental o planificar su éxito a largo plazo.

Conexiones

Le abrimos las puertas poniéndole en contacto con inversores, homólogos y socios alineados con su misión para apoyar su crecimiento sostenible.

Quién y qué financiamos

Invertimos en diversos empresarios -inmigrantes, de clase trabajadora y otros- que están creando empresas, cooperativas y proyectos inmobiliarios impulsados por la comunidad en Massachusetts, Nueva Inglaterra o el norte del estado de Nueva York.

Empresas de impacto

Soluciones innovadoras que apoyan los buenos empleos, amplían la propiedad de los trabajadores y aumentan la resistencia climática en toda Nueva Inglaterra.

Bienes inmuebles propiedad de la Comunidad

Proyectos que apoyan la propiedad y la gobernanza comunitarias y aumentan la asequibilidad: desde fideicomisos de tierras comunitarias hasta cooperativas de viviendas y empresas en Nueva Inglaterra.

¿Es BII Capital adecuado para usted?

Apoyamos a fundadores y organizaciones que ya están en marcha, con un modelo de negocio probado, ingresos tempranos y un compromiso con los resultados de impacto.

Podrías encajar bien si:

- Tiene su sede en Massachusetts, Nueva Inglaterra o el norte de Nueva York.

- Su empresa está generando ingresos o tiene demanda de clientes y está preparada para crecer.

- Su trabajo abre un mercado nuevo o insatisfecho, crea buenos empleosamplía la propiedad de los trabajadoresdesarrolla propiedad comunitariao promueve resiliencia climática.

- No no puede acceder al capital de fuentes tradicionales como bancos o fondos de riesgo

Opciones de financiación

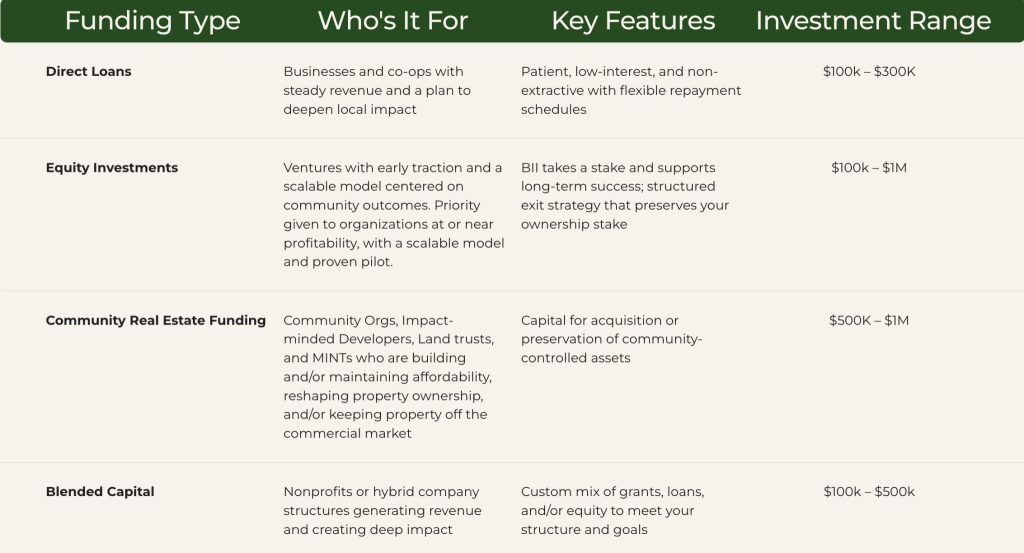

Tipo de financiación

Para quién

Características principales

Gama de inversión

Préstamos directos

Empresas y cooperativas con ingresos estables y un plan para aumentar el impacto local

Paciente, con bajos intereses y no extractivo, con planes de amortización flexibles

100.000 - 300.000 dólares

Inversiones de capital

Empresas con una tracción temprana y un modelo escalable centrado en los resultados comunitarios. Se dará prioridad a las organizaciones que sean o estén cerca de ser rentables, con un modelo escalable y un proyecto piloto probado.

BII toma una participación y apoya el éxito a largo plazo; estrategia de salida estructurada que preserva su participación en la propiedad

100.000 - 1 millón de dólares

Financiación inmobiliaria comunitaria

Organizaciones comunitarias, promotores con visión de impacto, fideicomisos de tierras y MINT que están construyendo o manteniendo la asequibilidad, remodelando la propiedad y/o manteniendo la propiedad fuera del mercado comercial.

Capital para la adquisición o conservación de bienes controlados por la comunidad

500.000 - 1 MILLÓN DE DÓLARES

Capital mixto

Organizaciones sin ánimo de lucro o estructuras empresariales híbridas que generan ingresos y crean un impacto profundo.

Combinación personalizada de subvenciones, préstamos y/o capital para satisfacer su estructura y objetivos

100.000 - 500.000 dólares

Todas nuestras inversiones están estructuradas para preservar su misión y apoyar el éxito a largo plazo. Para más opciones de financiación, visite nuestra sección Deuda y capital de deuda y capital.

Opciones de financiación

Todas nuestras inversiones están estructuradas para preservar su misión y apoyar el éxito a largo plazo. Para más opciones de financiación, visite nuestra sección Deuda y capital de deuda y capital.

Proceso de admisión inicial

-

1. Compruebe si cumple los requisitos

Asegúrese de que su empresa o proyecto cumple nuestros criterios.

-

2. Envíe un formulario de interés

Háblenos de su trabajo y del apoyo que necesita. Haremos un seguimiento de su solicitud.

-

3. Avanzar

Si está alineado, le guiaremos a través de nuestro proceso de inversión basado en la confianza.

Nuestro proceso de inversión basado en la confianza

Comprobar la admisibilidad

Comprobar la admisibilidad

Háblenos de usted

Háblenos de usted

Conoce al equipo

Conoce al equipo

Compartir cifras e impacto

Compartir cifras e impacto

Asistencia técnica y asesoramiento (en caso necesario)

Asistencia técnica y asesoramiento (en caso necesario)

Presente su visión

Presente su visión

Aprobación de inversiones

7. 7. Aprobación de la inversión

Due Diligence legal y Term Sheet

8. Due Diligence legal y Term Sheet

Financiación y asociación

Financiación y asociación

Cómo sostenemos su impacto

Estamos contigo en cada paso del camino. Mientras dure nuestra inversión, trabajaremos contigo para ampliar tu negocio y tu impacto, y fijaremos objetivos para apoyar tu crecimiento. Para asegurarnos de que vas por buen camino, te pediremos informes financieros periódicos y evaluaciones de impacto.

¿No sabe por dónde empezar?

Apoyo y recursos para empresarios

Más allá de la financiación, proporcionamos recursos, asesoramiento experto y coaching a las pequeñas empresas para garantizar su éxito a largo plazo.

Coaching

Acceso a mentores y asesores experimentados

Conozca los modelos cooperativos, la disponibilidad de financiación y el crecimiento empresarial

Conectar con otros empresarios de la red BII

Explorar los recursos empresariales

Acceda a las últimas perspectivas, datos y recursos sobre inversión de impacto, inversión por la justicia y fortalecimiento de la economía solidaria.

Preguntas frecuentes

¿Qué tipo de empresas o proyectos inmobiliarios tiene en cuenta BII?

Financiamos empresas, cooperativas y proyectos comunitarios que amplían el acceso a la propiedad, el empleo y la estabilidad local a largo plazo. Si su empresa está creando oportunidades económicas inclusivas y está arraigada en el impacto comunitario, puede ser una buena opción.

¿Cuáles son los criterios de inversión de BII?

Buscamos invertir en empresas sociales, incluidas las que son propiedad de personas de color y los proyectos inmobiliarios que están catalizando el poder en las comunidades de color. Buscamos a aquellos que compartan nuestra creencia de que es posible una economía sostenible, inclusiva y equitativa, así como quiénes son los propietarios, trabajan y ostentan el poder, y qué capacidad tiene la inversión para construir poder financiero, social y político para las comunidades de color.

¿Qué tipos de capital ofrece BII?

En el centro de nuestro enfoque está el despliegue de capital integrado, lo que significa combinar tipos de inversiónsubvenciones, deuda, capital-para atender a los empresarios y sus empresas allí donde se encuentren. Estructuramos las operaciones utilizando diversas estructuras financieras innovadoras:

Capital para pequeñas empresas | Deuda de las pequeñas empresas | Deuda y capital inmobiliario | |

Tipo de capital | Acciones preferentes Acciones ordinarias Bonos convertibles SAFEs | Asegurado Deuda no garantizada Líneas de crédito Financiación de cánones Financiación de créditos | Equidad Deuda Puente |

Creemos que el capital integrado es un catalizador de la justicia económica. Es fundamental en todos los aspectos de nuestro trabajo.

¿En qué fase invierte BII?

Invertimos en todas las fases: pre-semilla, semilla, puesta en marcha y crecimiento. Normalmente queremos ver que su empresa genera ingresos o tiene demanda de los clientes. Dicho esto, animamos a los emprendedores a que se pongan en contacto con nosotros tan pronto como lo deseen, ya que ofrecemos regularmente asesoramiento y asistencia técnica a empresas que aún no están preparadas para recibir inversión de BII, con el fin de ayudarles a prepararse para la inversión en el futuro.

¿Cuánto dura el proceso de inversión?

El proceso varía y depende en gran medida de la preparación de la empresa para la inversión. Dicho esto, muchas inversiones se completan en los 4-5 meses siguientes al formulario de interés inicial.

¿Cuál es el proceso de inversión de BII?

Las empresas y los proyectos inmobiliarios que buscan inversión pasan primero por nuestra diligencia debida basada en las relaciones, que considera tanto la viabilidad financiera de la inversión como su adecuación a nuestros criterios de inversión.

Durante este tiempo, nuestro equipo también presta con frecuencia asistencia técnica a las empresas, en temas que van desde la estrategia y las proyecciones financieras hasta la democracia en el lugar de trabajo y la propiedad equitativa. No utilizamos puntuaciones crediticias ni otros medios de evaluación financiera de poco tacto y sesgados históricamente. En su lugar, tratamos de comprender en profundidad la salud financiera, el posicionamiento y las personas que hay detrás de cada empresa para hacer una evaluación del impacto, el riesgo y la posible rentabilidad.

Una vez que una empresa pasa por el proceso de diligencia debida de nuestro equipo, éste la presenta al Comité de Inversiones de BII. El Comité de Inversiones es nombrado por el Consejo de Administración de BII para que emplee su experiencia en la evaluación de oportunidades de acuerdo con nuestra tesis de inversión. Los miembros del Comité de Inversiones aportan una amplia variedad de conocimientos: experiencia en finanzas, empresarios de éxito, principios de economía solidaria, inversores providenciales y líderes de organizaciones sin ánimo de lucro. Votan sobre cada inversión, recomendando la operación al consejo para su aprobación o dejando pasar la oportunidad en ese momento.

El Consejo da su aprobación final a cada operación para garantizar que nuestra actividad inversora se ajusta a nuestra misión.

¿Qué factores tiene en cuenta BII al evaluar una oportunidad de inversión?

Examinamos tanto la viabilidad financiera de las inversiones potenciales como su adecuación a nuestros criterios de inversión. En el aspecto financiero, revisamos documentos financieros clave, planes de negocio, proyecciones y otros factores específicos de la inversión para desarrollar nuestra evaluación. En cuanto al impacto, tenemos en cuenta una serie de factores relacionados con la justicia económica, la resistencia climática, la gobernanza y el poder, y la salud de la empresa. También evaluamos al personal de la empresa o el proyecto, ya que conocer a las personas en las que invertimos es una de las principales ventajas de un enfoque basado en las relaciones.

¿Qué ofrece BII a las empresas de su cartera más allá de su capital?

Como inversores de capital integrado, creemos que la mejor manera de apoyar a las organizaciones y construir una economía resiliente es proporcionar recursos complementarios a las empresas en cartera, además de nuestro capital financiero. Nos referimos a estos recursos como Asistencia Técnica (AT). Nuestra oferta de AT incluye

- Modelización financiera: Podemos analizar el rendimiento histórico y revisar o crear proyecciones.

- Capital social: Aprovechamos nuestra red en busca de contactos comerciales, expertos del sector, otros inversores y financiadores, socios potenciales u otros asesores y mentores.

- Coaching: Los miembros de nuestro equipo están disponibles para hablar sobre oportunidades o retos y ofrecer asesoramiento.

- Promoción: Utilizamos nuestra plataforma (redes sociales, sitio web y boletines informativos) para dar a conocer historias de éxito.

- Asistencia técnica especializada: Ofrecemos conexiones con proveedores locales de confianza de servicios de contabilidad, recursos humanos y marketing y comunicaciones. Ofrecemos subvenciones para sufragar parte de estos costes.

- Junta Consultiva de Cartera: Ofrecemos a nuestras empresas en cartera oportunidades adicionales para conectar, construir sus redes y aprender unos de otros. Cada año, invitamos a los líderes de las empresas de la cartera a unirse a nuestra Junta Consultiva de la Cartera, que ofrece: grupos de debate entre iguales, acceso a asesores estratégicos, creación de redes entre iguales y de relaciones estratégicas, y prácticas de sostenibilidad.

¿Listo para hacer crecer su negocio?

Empiece hoy mismo

Nuestro equipo le guiará a lo largo del proceso para determinar la mejor opción de financiación para su empresa o proyecto.