Build Community Ownership, Shared Wealth, and Economic Power

We believe in democratizing investment in local enterprises. Our Fund II is an integrated capital fund dedicated to building a just and sustainable economy.

About BII Fund II

Fund II was a target $20 million debt fund that invests integrated capital into early-stage, impact-driven enterprises owned by entrepreneurs of color and community-owned or governed real estate to prevent displacement in New England.

Our final closing was December 31, 2025. Fund II was oversubscribed at over $22 million with 245 investors committed to investing catalytic capital for community-wealth building.

Investment Focus

Fund II prioritizes investments in the following areas:

Social Enterprises

Businesses led by entrepreneurs and worker-owners from diverse communities that contribute to a sustainable and inclusive economy.

Community-Controlled Real Estate

Projects that prevent displacement and promote community ownership.

Climate Resilience

Enterprises pioneering clean energy solutions that build climate resilience in local communities.

Investment Strategy

Our integrated capital approach blends various forms of capital to meet entrepreneurs where they are:

- Debt Financing: Offering flexible loan terms tailored to the cash flow realities of small businesses.

- Equity Investments: Providing patient, non-extractive equity to support long-term growth.

- Grants: Supplying non-repayable funds to support capacity building and technical assistance.

Impact Goals

Through BII Fund II, we aim to:

Build Generational Wealth

Increase wealth-building opportunities for communities of color.

Empower Entrepreneurs

Enhance financial, social, and political power for business owners of color.

Promote Sustainable Practices

Support enterprises that prioritize environmental stewardship.

Notes Offering

BII Fund II is offering the following types of notes to accredited and non-accredited investors:

- Community Notes: 5% Notes maturing 12/31/2027 to non-accredited investors residing in Massachusetts, Maine, New York, New Hampshire, Rhode Island, Connecticut and Vermont in amounts ranging from $1,000 to $25,000, renewable until 12/31/2032 at a 7% interest rate per year.

- Solidarity Notes: 3% Notes maturing 12/31/2032 to accredited investors in amounts ranging from $10,000 to $3,000,000.

- Philanthropic Notes: 1% Notes maturing 12/31/2032 to accredited investors in amounts ranging from $10,000 to $3,000,000.

The Fund II Note Offering completed a final close of $22.3M on December 31, 2025 with 245 investors.

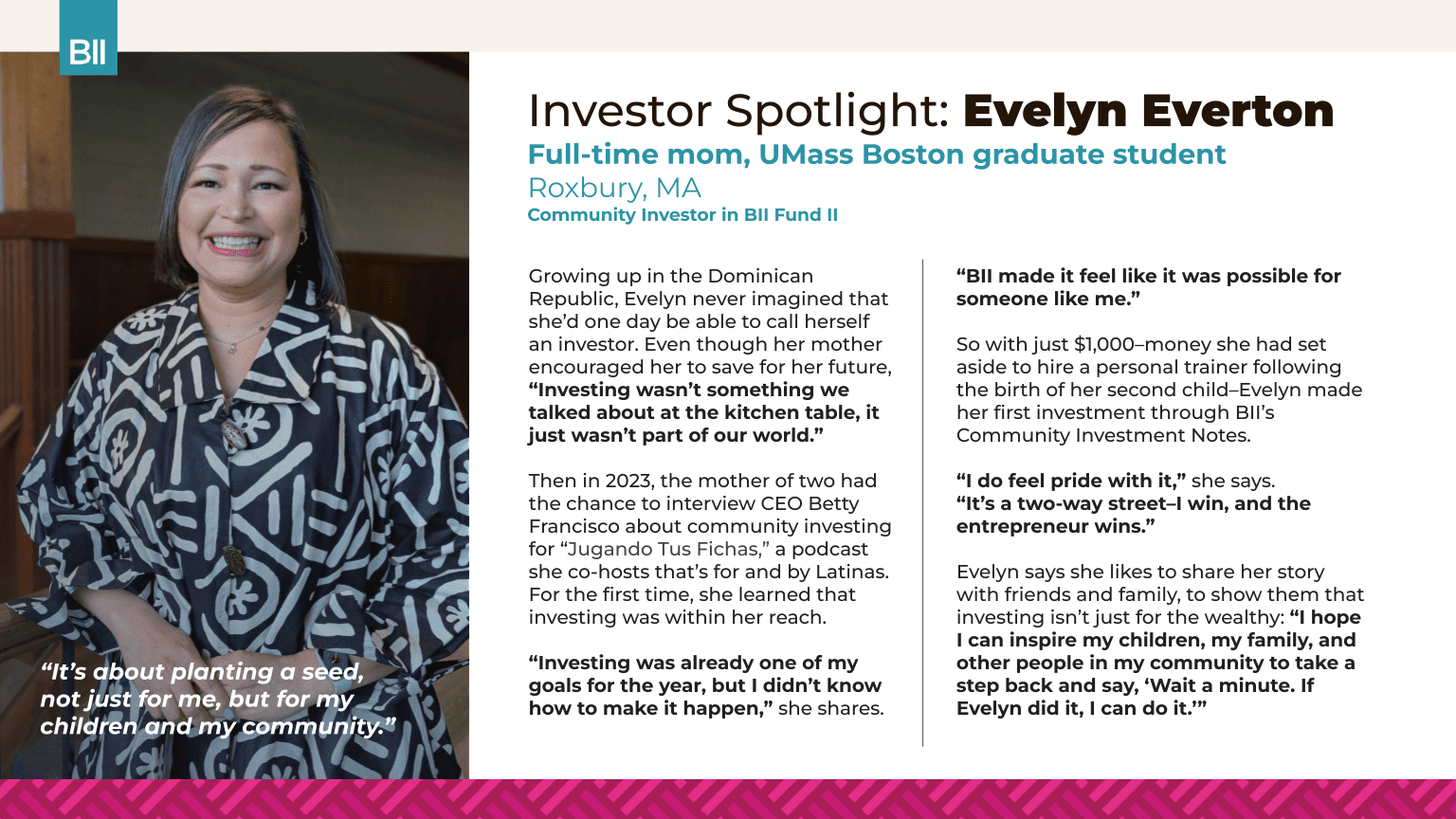

Read about our investors

Our investors include individuals, businesses, nonprofits, foundations, faith-based organizations and financial institutions that want to support our investments in enterprises and projects driving racial equity, power-building and shared prosperity for everyone.

Why Invest

An investment allows us to provide patient, non-extractive equity and flexible debt capital to the people and places that need it the most. In turn, investors receive an integrated return on investment to catalyze wealth and asset-building opportunities for communities of color.

Frequently Asked Questions

What is integrated capital?

Integrated capital refers to the coordinated use of different forms of financial and non-financial resources to support enterprises that are creating social and environmental impact.

How are investment decisions made?

Our investment committee evaluates opportunities based on financial viability, alignment with our mission, and potential for social and environmental impact.

Who can invest in Fund II?

Fund II welcomes investments from accredited and non-accredited investors, including individuals, businesses, nonprofits, foundations, faith-based organizations, and financial institutions, as well as philanthropic contributions.

What is the minimum investment amount?

For Community Investors, the minimum investment is $1,000, with a maximum of $25,000. For Solidarity and Philanthropic investors, the minimum is $10,000, with a maximum of $3,000,000.

How are the funds used?

Investments support impact-focused enterprises owned by entrepreneurs and worker-owners from diverse communities, and community-owned real estate projects aimed at preventing displacement.

Join Us in Advancing Economic Justice and Community Development

Invest in Fund II and support the growth of enterprises, building a more just and sustainable future.