As we close out 2025, we find ourselves reflecting on a year that tested our resolve and reaffirmed our purpose. Against a backdrop of policy reversals, federal funding cuts, and economic volatility, BII didn’t retreat, we coordinated. We mobilized investors. We increased deployment. We launched new programs. We stood in solidarity with entrepreneurs navigating unprecedented uncertainty, providing not just capital but thought partnership, legal education, and connection to business development resources.

This year taught us a powerful truth: when systems fail, movements scale. And scale we did.

A Year of Strategic Growth

Despite—or perhaps because of—the challenging policy environment, 2025 marked significant milestones for BII:

We achieved CDFI certification in January, a recognition that arrived just as threats to the CDFI Fund itself intensified. This milestone wasn’t just symbolic; it came with a technical assistance grant that helped us build the infrastructure our communities deserve.

We closed Fund II, exceeding our $20 million goal by year’s end. This capital is now deployed in businesses building community wealth, accelerating the clean energy transition, and expanding cooperative ownership models.

We invested $4.2M through BII Fund II, including follow-on support to proven partners and first-time investments in enterprises advancing housing justice, mental health equity, sustainable transportation, and clean energy manufacturing.

Investing in Resilience and Regeneration

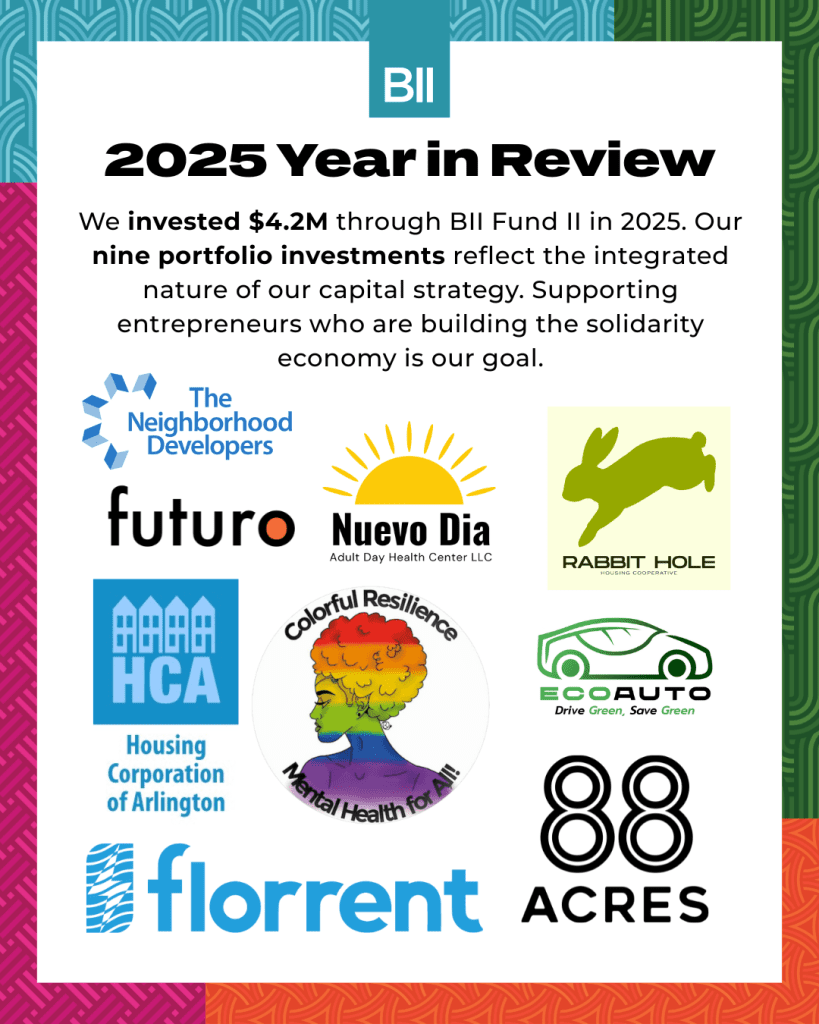

Our 2025 portfolio investments reflect the integrated nature of our capital strategy—supporting entrepreneurs who are building the solidarity economy we need:

- Futuro Media Group launched Futuro+, their first membership-based service, moving toward sustainability and self-determination in media

- 88 Acres expanded distribution of allergen-free foods, making nutrition more accessible

- Colorful Resilience brought trauma-informed, culturally responsive mental health services to underserved communities

- EcoAuto continued making electric and hybrid vehicles affordable for working families

- florrent scaled up manufacturing of supercapacitors for energy storage.

- Nuevo Dia Adult Day Health Center is building a second location with follow-on capital

- Housing Corporation of Arlington preserved 59 units of affordable housing, pulling them from speculative markets into permanent community control

- Rabbit Hole Housing Cooperative created cooperatively-owned housing for queer and transgender people of color in Portland, Maine

- The Neighborhood Developers acquired 30 units of naturally occurring affordable housing in Chelsea, Massachusetts, protecting low-income families and recent immigrants from displacement

Each investment represents more than capital deployment—it’s a commitment to entrepreneurs who center justice, care, and community in everything they build.

Building the Field

Our field-building and technical assistance work expanded significantly in 2025:

The ARC Fellowship welcomed its fifth cohort of 10 fund managers from across the U.S., responding to a record number of applications. Since inception, ARC-trained funds have deployed over $15 million in community capital.

The GreenEdge Accelerator, funded by MassCEC, launched its inaugural program to help women- and minority-owned businesses transition into climate-critical sectors. In December, we celebrated the first cohort at their capstone event.

The Business Resiliency Fund provided $50,000 in grants within weeks of launch, with 12 portfolio companies accessing support for financial management, HR consulting, AI workflow training, and leadership coaching. Demand was so immediate that we’re now raising $150,000 to scale the program.

The Portfolio Advisory Board completed its first year, reshaping how we support entrepreneurs beyond capital with strategic guidance drawn from lived experience

Integrated Capital Education

This year, we trained 236 members of the impact finance community across workshops and conference sessions using our Integrated Capital Cards.

Growing Our Team and Capacity

To meet this moment, we welcomed six new team members in 2025:

- Adeline Tavarez, Program Manager, Impact Capital Lab

- Doménica Good, Senior Marketing and Communications Manager

- Lubna Maria Elia, Managing Director, Impact Capital Lab

- Nalee Yang, Staff Accountant

- Walther Morales Rios, Senior Program Manager, Business Support Programs

- William Tsoules, Director of Finance

We also refreshed our Investment Committee, welcoming Marcia Chong Rosado and Zack Neville Young, and congratulating Evren Ozargun on his appointment as Chair.

Recognition and Visibility

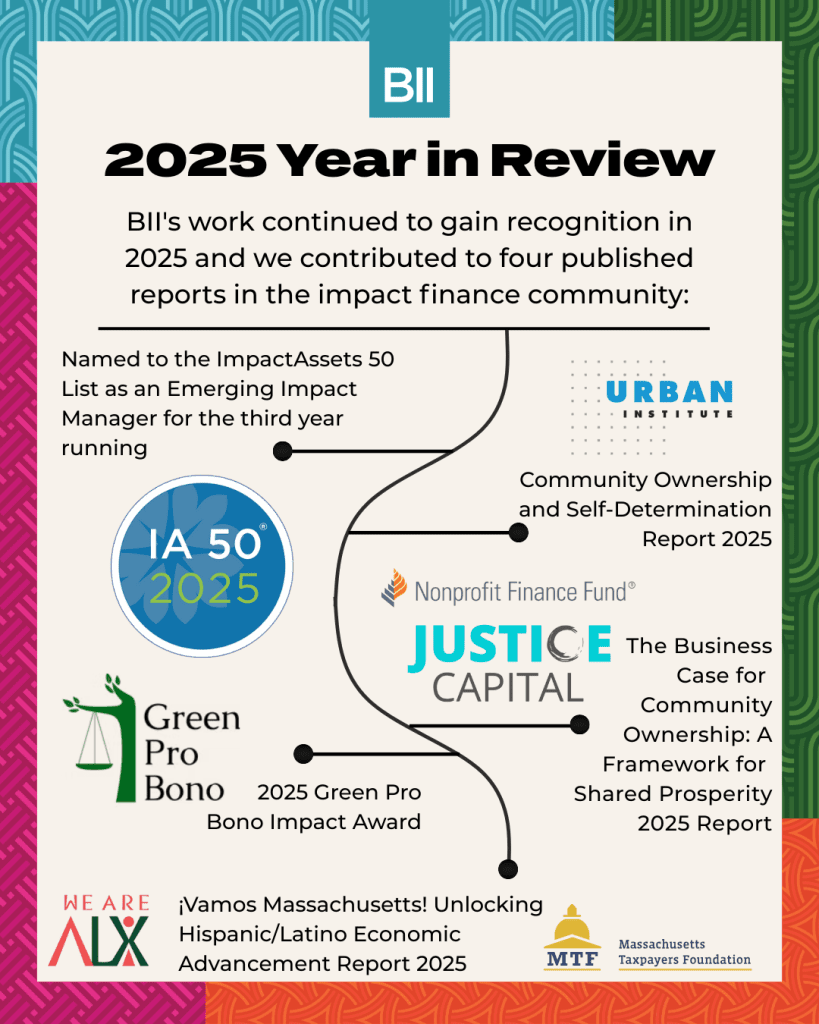

BII’s work continued to gain recognition in 2025:

- Named to the ImpactAssets 50 List as an Emerging Impact Manager for the third year running

- Awarded the Green Pro Bono 2025 Impact Award for our GreenEdge Accelerator, rooted in community-centered values and environmental justice

- Collaborated on four industry reports including ¡Vamos Massachusetts! Unlocking Hispanic/Latino Economic Advancement Report 2025 (Massachusetts Taxpayers Foundation & We Are ALX); Community Ownership and Self-Determination (Urban Institute); Creating Economic Growth and Thriving Small Businesses Through Equity Investing (Siegel Endowment & ICA Fund); and The Business Case for Community Ownership: A Framework for Shared Prosperity (Justice Capital and Nonprofit Finance Fund)

- CEO Betty Francisco recognized among the 150 Most Influential Bostonians by Boston Magazine (third consecutive year), named to the Boston Business Journal Power 50: Movement Makers, honored with the WOCE Entrepreneur Champion Award, and appointed to the Boston Federal Reserve Bank Board of Directors

- Investment Director Henry Noël Jr. joined the T25 Fund-led Governance Circle and the Partnership for Financial Equity board

- Director of Business Support Services Samalid Hogan was recognized by ALX100 Latino Leaders 2025

What Our Entrepreneurs Accomplished

Our portfolio companies didn’t just survive 2025—they thrived:

- EmVision Productions honored as SBA’s Microenterprise of the Year and awarded the Comcast RISE Program grant, and Dr. Tariana V. Little, CEO & Founder, recognized by ALX100 Latino Leaders 2025

- Futuro Media won four Signal Awards for podcasts including Suave, Lost in Queer Translation, and The Misinformation Web

- Boston While Black’s Sheena Collier named among the 150 Most Influential Bostonians

- THRIVE! AI closed their pre-seed stage supporting over 120,000 students across three states

- ChopValue honored with A&W Award of Excellence

- EcoAuto named a 2025 Top Rated Dealer on CarGurus

Moving Capital Off the Sidelines

As we look toward 2026, our message is clear: the movement to mobilize catalytic capital is powerful and growing, but we need more investors willing to move first—to take calculated risks that shift markets and change narratives.

There are concrete ways to act now:

- Make a tax-deductible donation to support our field-building work and Business Resiliency Fund

- Provide grant capital for the First Mover Fund to unlock investments in emerging fund managers

- Connect with us to explore how you can deploy more capital for transformative change

Built for This Moment

We weren’t founded for times of ease. We were built to meet moments like this—moments that demand solidarity, resilience, and strategic clarity. The systemic inequities we confront today are the same ones that inspired BII’s founding.

As Investment Director Henry Noël Jr. wrote: “We are not new to this; we are true to this.”

Thank you for building with us. Thank you for believing that another economy is not only possible—it’s already being built, one investment and one partnership at a time.

Together, we’re not just funding businesses. We’re building community ownership, worker power, and generational wealth. We’re pioneering new investment models because current financial systems do not serve our ambitious entrepreneurs well. And in that process, we’re building toward our vision of a solidarity economy where all our communities can thrive.

Here’s to the year ahead—and to the world we’re building together.

BII is a nonprofit impact investing fund and certified Community Development Financial Institution (CDFI) focused on entrepreneurs and impact fund managers advancing economic justice and community development. We invest in people and places building community ownership, shared wealth, and economic power, particularly in communities of color.