Advancing Regenerative Capital

The ARC Fellowship

The ARC Fellowship

A transformative learning community where visionary fund managers design, launch, and lead funds that drive economic, and environmental justice.

The ARC Fellowship is Boston Impact Initiative’s flagship cohort-based education program for fund managers, capital stewards, and community wealth builders working to advance racial, economic, and climate justice through finance. Founded in 2020 as the Integrated Capital Fund Manager Fellowship, the program is now entering its fifth cohort in 2025.

Grounded in technical rigor and systems change, the ARC Fellowship equips fund leaders with the tools, relationships, and strategies to design and manage impact-first, integrated capital funds rooted in community power and purpose.

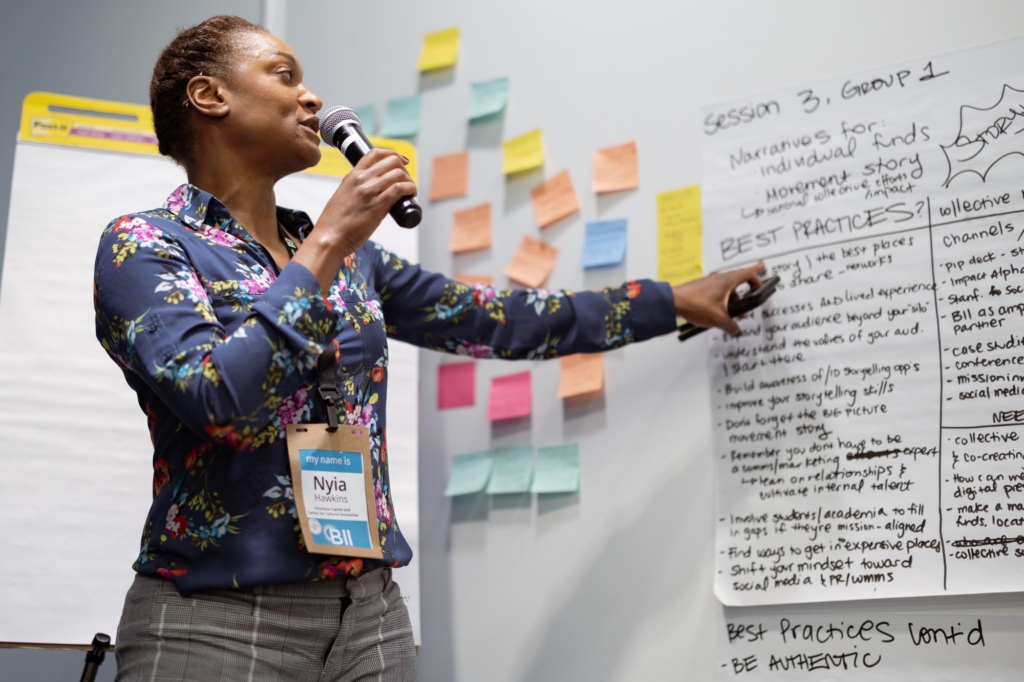

Over the course of this immersive eight-month journey, ARC Fellows participate in expert-led workshops, personalized coaching, and a peer learning network of impact fund managers and aligned investors. Fellows gain practical experience in designing fund structures, raising catalytic capital, and mobilizing resources in service of community ownership, economic resilience, and climate sustainability.

The ARC Fellowship is not just about fund development—it’s about building lasting community wealth, leadership, and power while shaping the future of regenerative finance.

At BII, we define regenerative capital as capital that restores rather than extracts. It flows into communities—not out of them—and is deployed with purpose, patience, and reciprocity. Regenerative capital is structured to circulate locally, support long-term community ownership, and build economic systems rooted in care, resilience, and shared prosperity.

Unlike extractive capital, which concentrates wealth and power, regenerative capital seeks to repair harm, equitably distribute opportunity, and sustain life—financially, socially, and ecologically.

The ARC Fellowship provides a 12-session, systems change-focused curriculum designed to equip fund managers with the skills and strategies to launch and scale community-based impact funds.

Formerly the Emerging Fund Manager Cohort Program, the ARC (Advancing Regenerative Capital) Fellowship is a hands-on, peer-driven education program for emerging and established fund managers who are designing and launching funds that advance racial, economic, and environmental justice. Fellows gain access to expert-led learning, peer support, catalytic capital, and a lifelong community of practice.

The Fellowship is designed for fund managers at all stages—whether you are in the early design phase, actively launching your fund, or scaling an established model. Ideal applicants are committed to using capital as a tool for social, economic, and environmental justice.

We welcome a diverse range of fund types, including:

Place-based funds serving specific communities

The Fellowship runs for six months, with 12 live, interactive sessions held bi-weekly (August–December), followed by a Winter Deep Dive Series (January–March) for advanced training. Sessions are delivered virtually for accessibility, with additional in-person events at the annual Summit & Showcase.

Core topics include:

Fellows learn from a diverse group of seasoned fund managers, legal and compliance experts, impact investors, and BII’s leadership team. Past mentors include leaders from Black Farmer Fund, CLLCTIVLY, and Denkyem Co-Op.

Applicants should have a clear fund idea or existing fund model focused on racial, economic, or environmental justice. We welcome solo fund managers, teams, and organizations designing or scaling mission-driven funds.

Yes. Our curriculum is designed to help you refine your fund concept, develop a viable model, and navigate the legal, financial, and strategic steps required to launch.

Yes. We encourage teams to apply and up to three members may participate under a single registration, ensuring your team gains shared knowledge and skills.

Our content and expertise is applicable to US-based funds only.

Applications are reviewed by a selection committee that considers mission alignment, fund concept clarity, potential for impact, and readiness to benefit from the program. Selected applicants will be invited for a brief interview before final decisions.

Fellows receive:

Access to the First Mover Fund and Fund Incubator for catalytic capital and advisory services.

The First Mover Fund is a flexible, mission-aligned funding source available to fellowship alumni. It provides catalytic capital (grants, recoverable grants, and low-cost loans) to help you launch or scale your fund.

The First Mover Incubator offers tailored advisory support to help you design, launch, and operate your fund. This can include legal compliance, back-office support, capital raising, and fund structuring.

Yes. In addition to peer networking, Fellows gain access to investor convenings, pitch opportunities, and direct introductions to mission-aligned investors through the BII network.

The total cost of the ARC Fellowship is $10,000 per team, which includes access to all curriculum sessions, coaching, advisory support, and membership in the BII Fund Manager Network.

Yes. We are committed to accessibility and equity. Scholarships and sliding scale options are available for mission-aligned teams with demonstrated need.

Yes. Payment plans can be arranged to help you manage the cost of participation.

Refunds may be considered on a case-by-case basis before the program start date. Once the program begins, fees are generally non-refundable.

Graduating Fellows join a lifelong community of practice, with continued opportunities to:

Lead or participate in future fellowship sessions as a mentor.

Yes. Alumni can access ongoing coaching and advisory support, as well as join advanced training sessions in the Winter Deep Dive Series.

Fellows join the BII Fund Manager Network, where they can connect with peers, access exclusive resources, and receive updates on new opportunities.

Whether you are an investor or a philanthropic donor, your support of BII will have a transformative effect in closing the racial wealth gap and creating an economy that works for everyone.